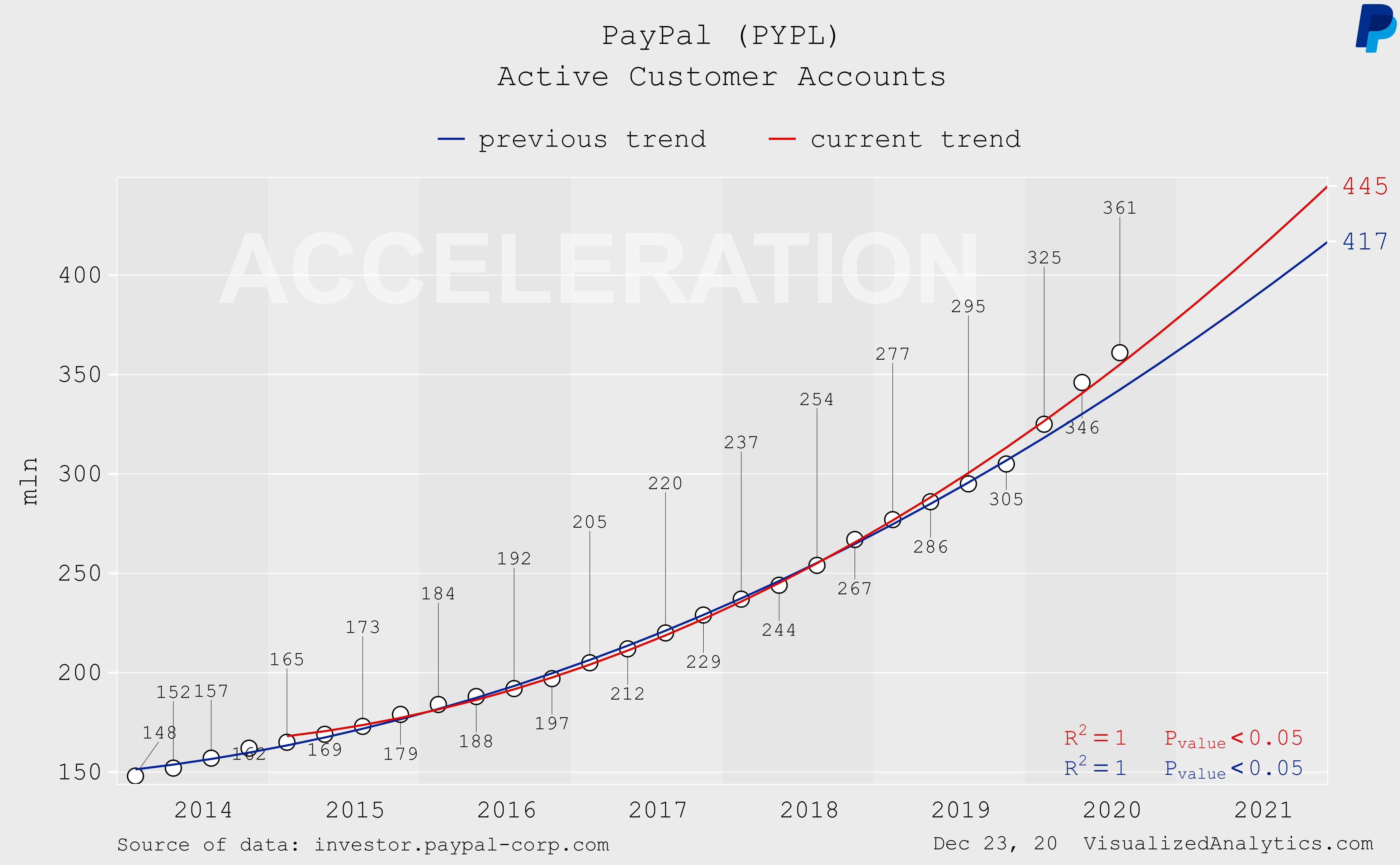

These trends aren't glitches-they are part of a larger, high-level behavioral shift in buying trends that will continue for several years and which will directly benefit e-commerce payment solution providers like PayPal.Īnalysts also expect that double-digit top line growth will return to PayPal within the next few years.īy FY2024, the consensus view among 34 analysts is that the company will post a 12.5% top-line gain year-over-year. Holiday Spending Increase by Category (SpendingPulse)įurther, e-commerce represented 21.6% of total estimated retail sales, up from 20.9% in 2021. What's more, PayPal's niche-e-commerce spending-was the highest performing category, clocking in nearly 11% increase. Mastercard's ( MA) analytics unit SpendingPulse recently reported that, despite the blaring negative headlines, spending was actually up nearly 8% year-over-year during the holiday season. Growth Will ReturnĪmidst the gloom of recent headlines that this past holiday season was a bit of a flop, it might be surprising to know that it held signs of hope for PayPal's business, which we believe will reflect positively on the company's upcoming earnings report. Can anyone reasonably say that the company today deserves a lower multiple than it did in 2016? We remind readers that the company has not stopped growing, only that growth is expected to slow to the high-single digits for 2022. The company's profitability has remained intact, and the balance sheet is a model of good health. This, to us, demonstrates the madness of the market-the company's sales have nearly tripled while EBITDA has doubled in the last seven years. Fast forward to today, where the stock trades at an even lower multiple: PayPal is expected to report $27 billion in annual revenue and just over $4 billion in EBITDA in 2022. In that year, PayPal recorded $10.8 billion in revenue with an EBITDA of $2.1 billion. To demonstrate the scale of the overreaction the market has had with PayPal, let's go back to the last time the stock traded close to 12x EV/EBITDA, which was around 2016. PayPal currently trades at a 12.1x EV/EBITDA multiple, far below its historical mean of 22x.īased on the chart above, someone with no knowledge of PayPal's business might be forgiven for assuming that PayPal is just another tech-wreck-an unprofitable and overvalued company that soared too close to the sun only to be brought down by rising interest rates. This pressure has reduced PayPal's valuation to levels not seen since, well, ever in the company's publicly traded history. economy, worsening macro conditions around the globe, and tales of woe from retailers that this past holiday season was slower than usual have contributed to the steady downward pressure on the stock. Further, consumer softness across the U.S.

Most analysts expect PayPal's 2022 revenue to have grown only 8% from 2021 levels, a rate which falls far short of the company's historical record of delivering double-digit growth rates.

PayPal's fall in price from its high of just above $300 to its current level just south of $80 is a result of slowing growth. All of this, in our view, presents a compelling case for investors. We believe that PayPal is attractively priced at these current levels, that activist investors will assist management in producing solid results and margins, and that the company has many years of runway ahead of it. In our view, the selloff of last year was warranted (the company had been trading at over 60x forward earnings), but alas, the market now seems to have gone too far. The stock plummeted by over 60% against a backdrop of rising interest rates and recession fears. Like most other tech companies, PayPal's ( NASDAQ: PYPL) 2022 was a year to forget.

0 kommentar(er)

0 kommentar(er)